To visitors staying overnight in Kyoto City

Guide to

the Accommodation Tax

2018.10.1~

- Who pays

the tax? - Visitors who have stayed overnight in lodging facilities in Kyoto City

- How is the tax paid?

-

Please pay at the lodging facility in which you are staying.

Visitors who have already paid the tax to a private lodging broker or travel agent do not need to pay the tax at the lodging facility.

| Accommodation Charge Person Per Night | Tax Amount |

|---|---|

| Under 20,000 JPY | 200 JPY |

| 20,000 JPY to 49,999 JPY | 500 JPY |

| 50,000 JPY and over | 1,000 JPY |

“Accommodation charge” does not include meals, consumption tax, bathing facility tax, etc. This is only the cost of the overnight stay and associated service charges.

The accommodation tax will be used for expenses aimed at enhancing attractiveness of Kyoto as an international cultural tourism city and at promotion of tourism.

In the city of Kyoto, urgent issues such as improvement of environment for receiving tourists and countermeasures against traffic congestion have arisen due to an increase in visitors to the city, and some of them have an impact on the lives of citizens to the extent that the citizens feel burdened by them. Therefore, in order to further improve administrative services dealing with these issues and to solve them, we will be using the accommodation tax revenue for the following measures.

Promotion of efforts allowing

to feel the dignity and

appeal of Kyoto

for both its citizens and visitors

Preserving and enhancing attractive scenery

Improvements in environment for receiving tourists according to changes in the situation around tourism, such as the increase in visitors to Kyoto

Resolving congestion on roads and walkways

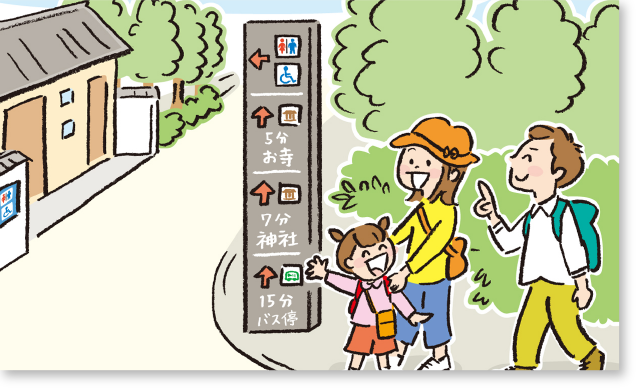

Easily understood guides to sightseeing

Regulation of unlicensed private

lodging houses

Other examples: Securing safety and security of visitors to Kyoto Expansion of restroom facilities at sightseeing spots

The illustrations show examples of how the tax is used.